SSS Monthly Contribution Table & Schedule of Payment 2023 The Pinoy OFW

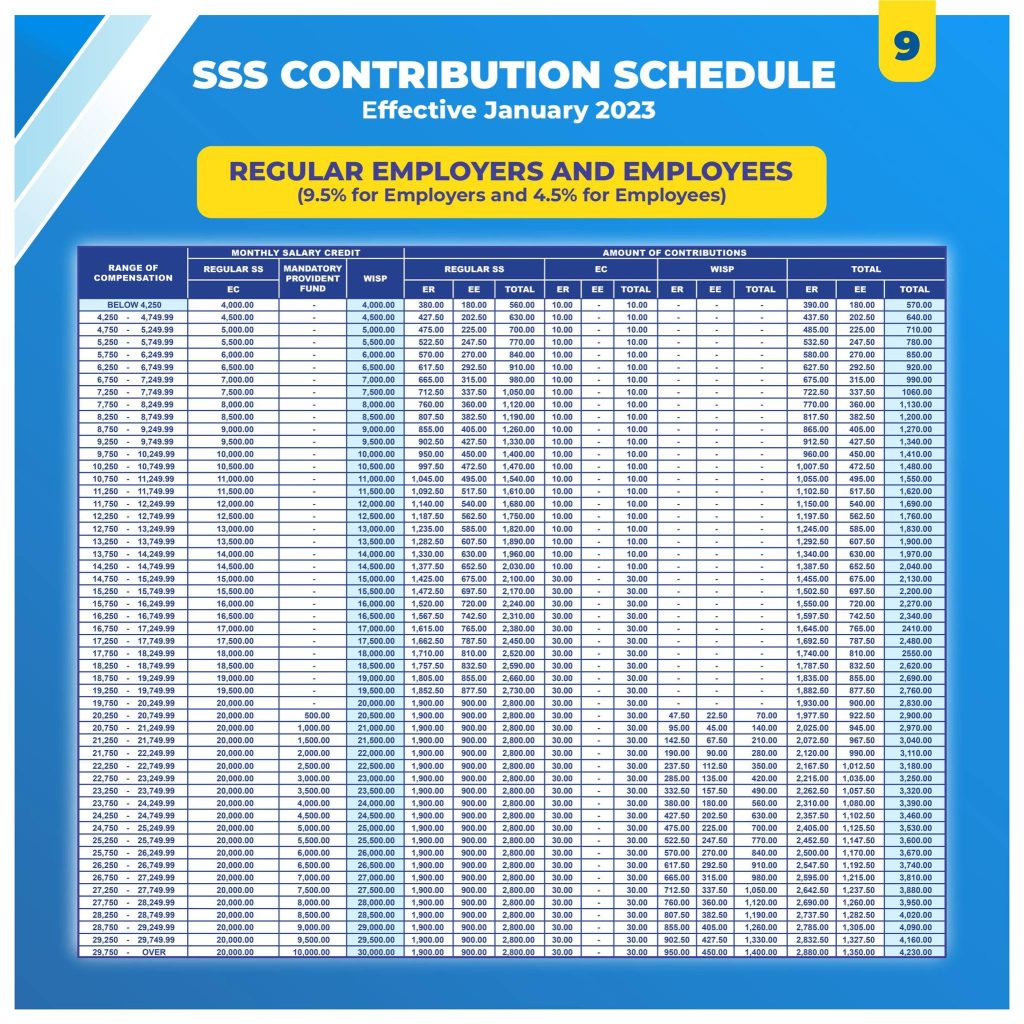

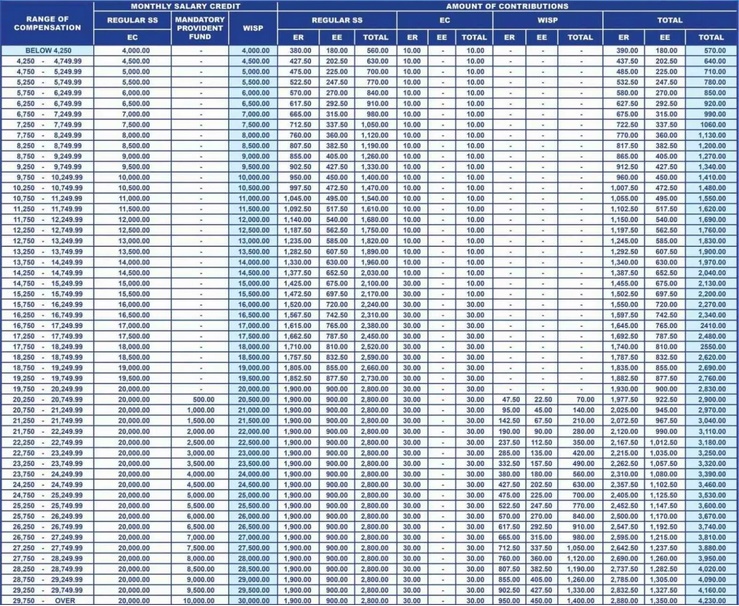

4. Calculate your Monthly Contribution. To calculate your monthly contribution, multiply your monthly salary credit by your contribution rate. Continuing with the example above, if your monthly salary credit is Php 20,000 and your contribution rate is 4.5%, your monthly contribution would be Php 900 (20,000 x 4.5%).

Pin on Quick Saves

SSS Building East Avenue, Diliman Quezon City, Philippines. 02-1455 or 8-1455. https://crms.sss.gov.ph

SSS Contributions Table and Payment Deadline 2020 SSS Inquiries

Step 1: Visit the SSS Website Access the SSS website at www.sss.gov.ph. Upon entering the website, an I'm not a robot pop-up will appear. Check the box and click Submit. Step 2: Log in to Your My.SSS Account

SSS Contribution Table 2023 SSS Answers

Established in 1957, the SSS is a government-run social insurance program for employees in the Philippines. The agency provides various benefits, including sickness, maternity, and even retirement to all registered members. To become an SSS member, you must be at least 15 years old.

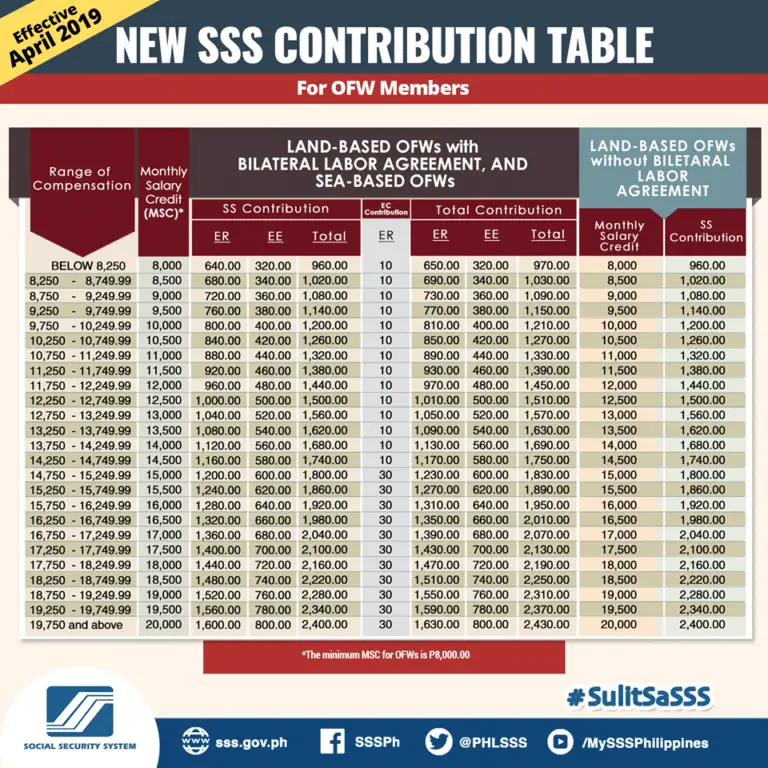

SSS releases contribution table for OFWs; P2,400 premium payment takes

If you're not familiar with how to pay SSS contributions, the first step is to generate your employees' Payment Reference Number (PRN). You can log into your SSS account to do this. After generating the PRN, you can submit it along with the payment amount through any partner center.

SSS Contributions Table and Payment Deadline 2020 SSS Inquiries

Members pay a monthly contribution to this government agency, and SSS uses it to provide benefits like retirement pensions and salary loans. You may have been wondering how much you're giving to SSS, and we've made this guide to help you compute your monthly SSS contribution.

Sss Contribution Online Payment Guide For Ofw Self Employed And

Simply go to this website: https://www.sss.gov.ph/sss/rcsmi/main.html to get started and take the following steps: Accomplish all fields of the online form correctly. A link shall be sent to the registrant's email which will enable them to continue with their SS Number application.

New SSS Contribution Table 2023 (Everything you need to know) SSS Answers

How to Check My SSS Contributions Online? Type www.sss.gov.ph on your browser's address bar. The SSS Website Homepage will appear. On the right side of the page, you will see an Employee login section or go to this link. Enter your user name and password then click Submit. 2.

Rate SSS Contribution 2023 Here's Guide on How Much You Must Pay as

The Social Security System released the new SSS contribution brackets for 2024. Effective January 2024, SSS members must comply with the updated monthly contributions to maintain their active membership status.

HR/Payroll Or A Business Owner? Here’s A Guide To Prepare For SSS

Select Your Membership Type, Applicable Period You Want To Pay for, and Your New SSS Contribution Amount. 5. Copy the Payment Reference Number (PRN) 6. Make a Payment. 1. Log In to the SSS Mobile App With Your User ID and Password. 2. Select Generate PRN at the Bottom of the App Dashboard.

How much is SSS contribution per month? Bestbrainz Philipines

What is SSS? Why is SSS important for retirement? How do I benefit from it? How to Apply for an SSS Number How to apply for SSS online Member Data Amendments SSS Online Registration: Creating an Online Account for your SSS Step 1: Go to the SSS website's online registration page Step 2: Click the "Not Registered" option on the lower-right corner

50 best ideas for coloring Sss Employees Contribution Table

The amount of contribution ranges from PHP 560 to PHP 4,200 per month. Calculate your SSS Contributions for Voluntary and Non-Working Spouse Membership with our SSS Contribution Calculator. Benefits of Voluntary Contributions for Non-Working Spouses Voluntary and non-working spouse members may be eligible to receive the following benefits: 1.

SSS Contribution Table and Deadline of Payments Business Tips Philippines

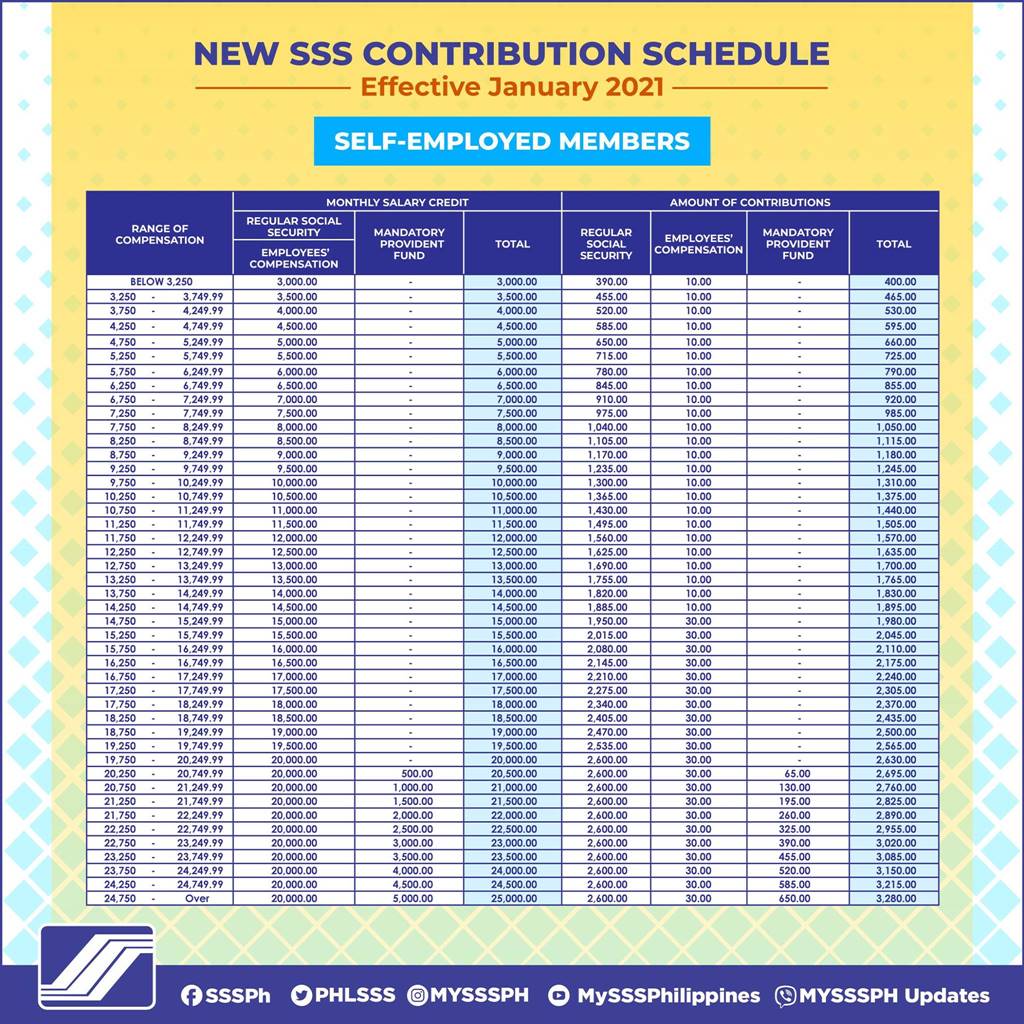

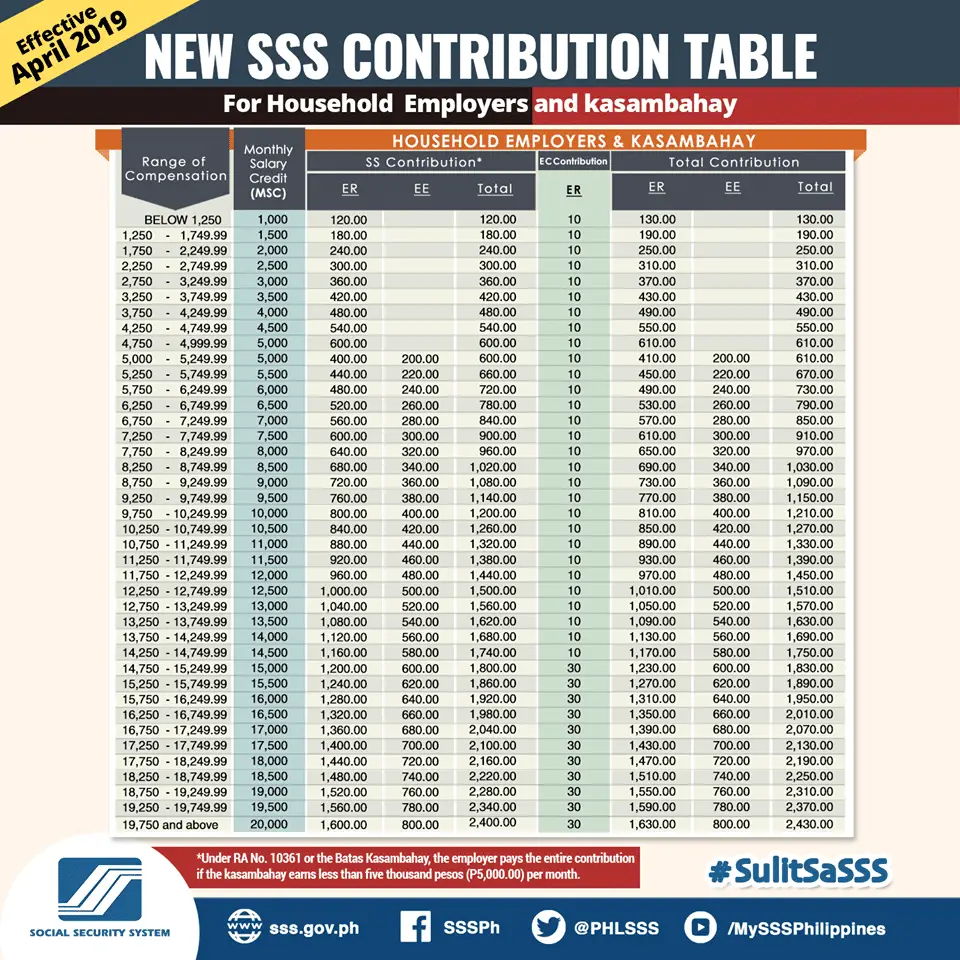

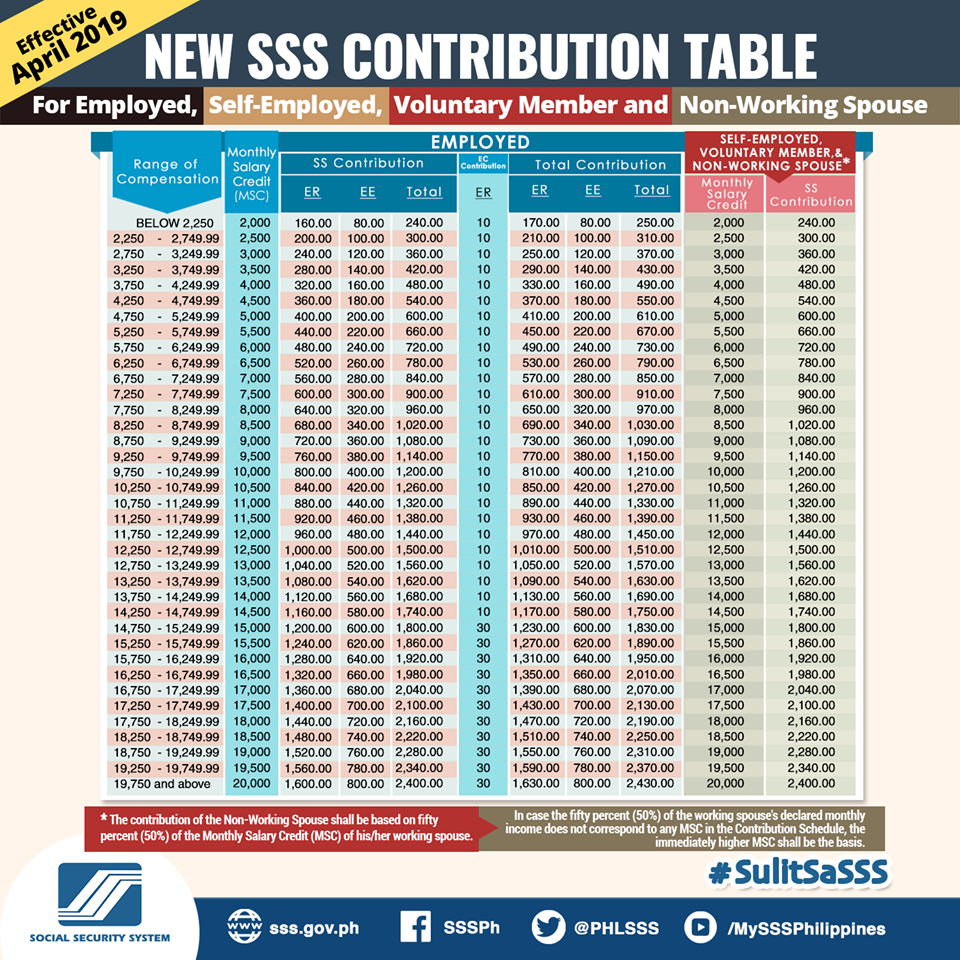

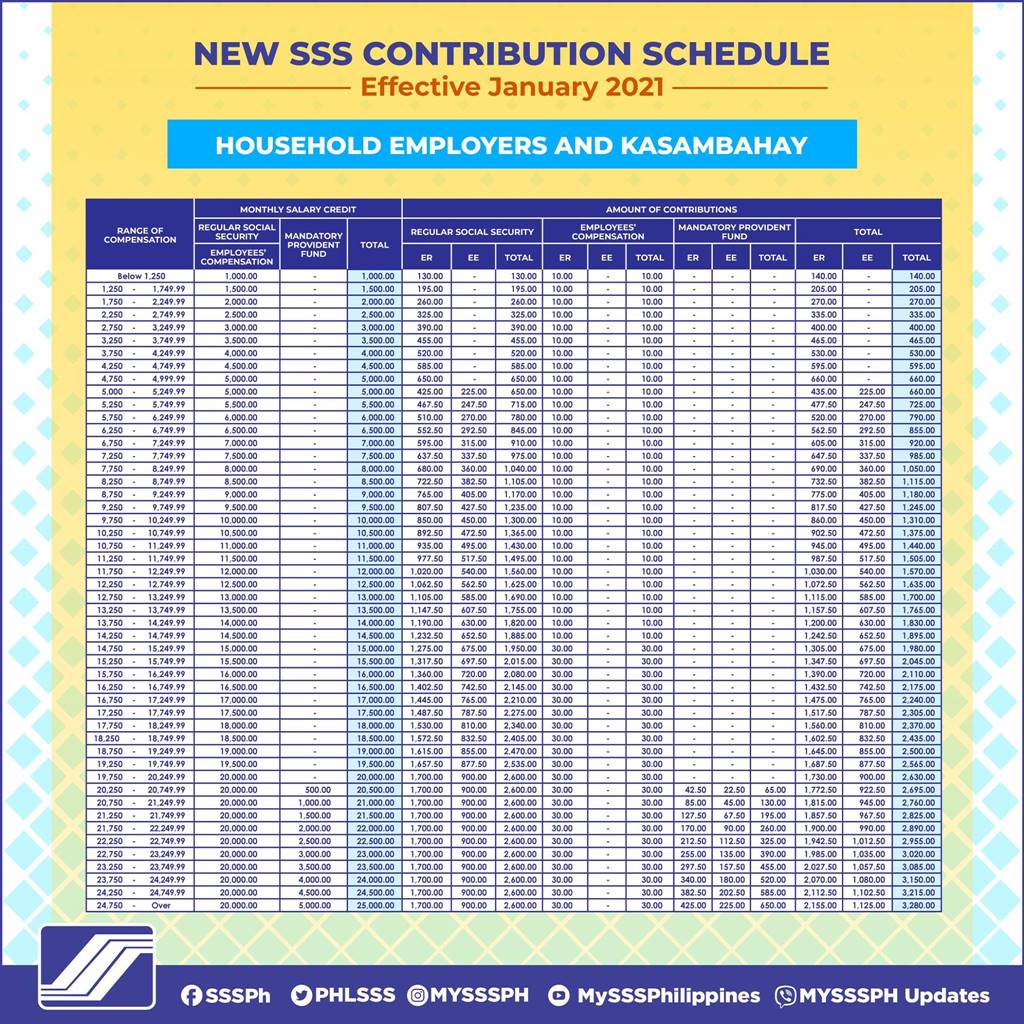

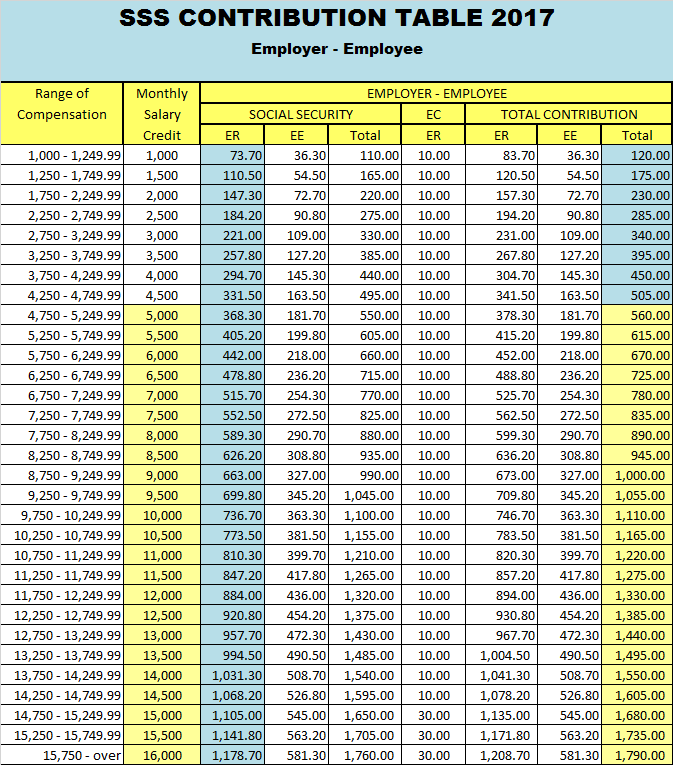

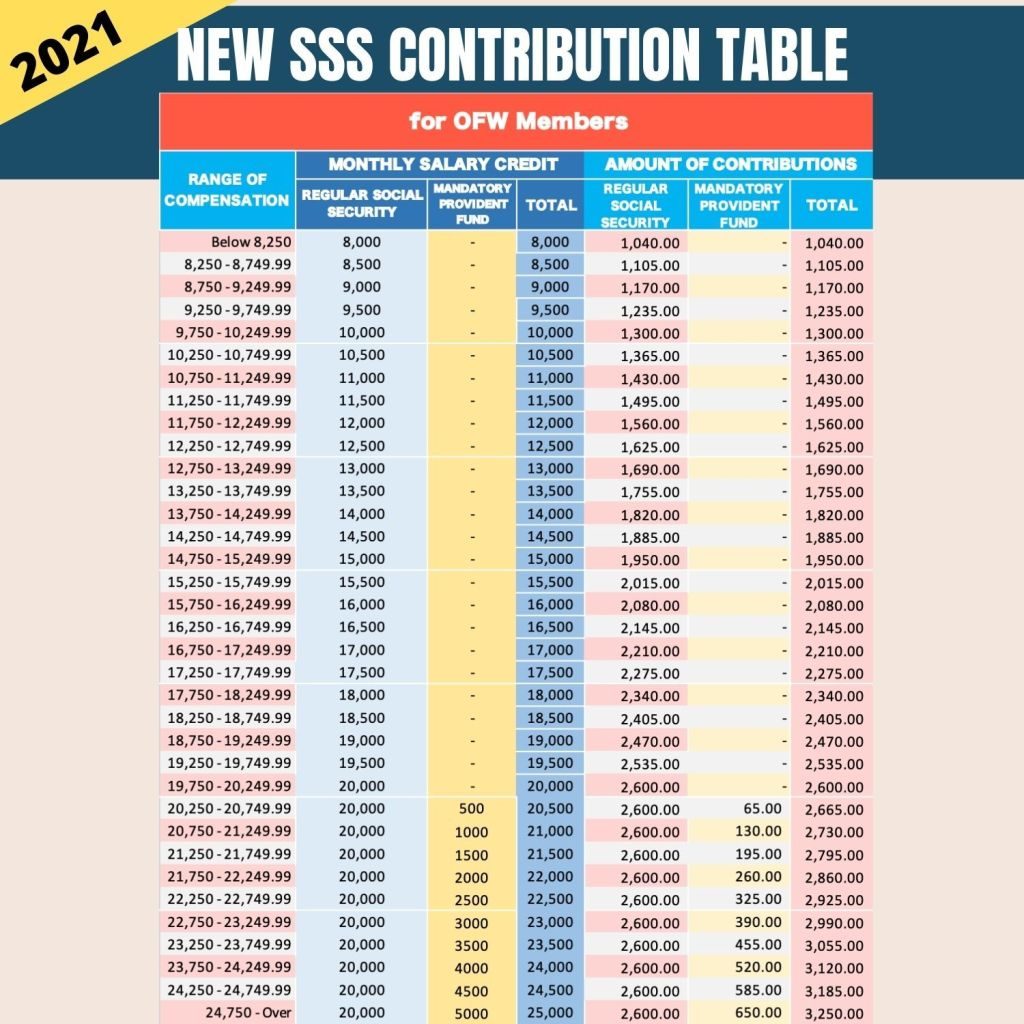

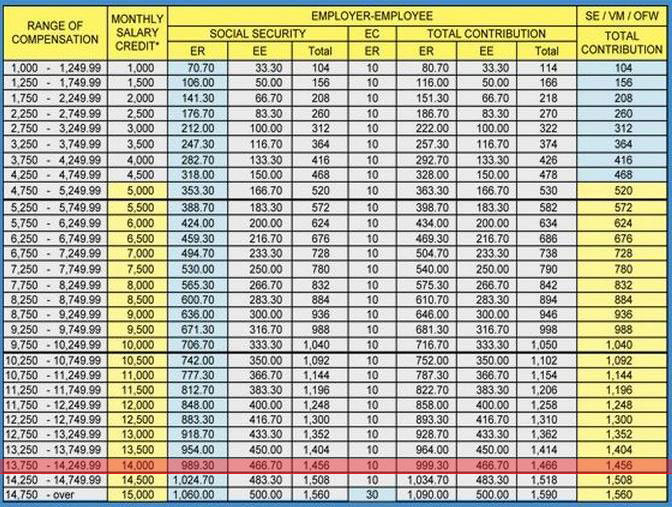

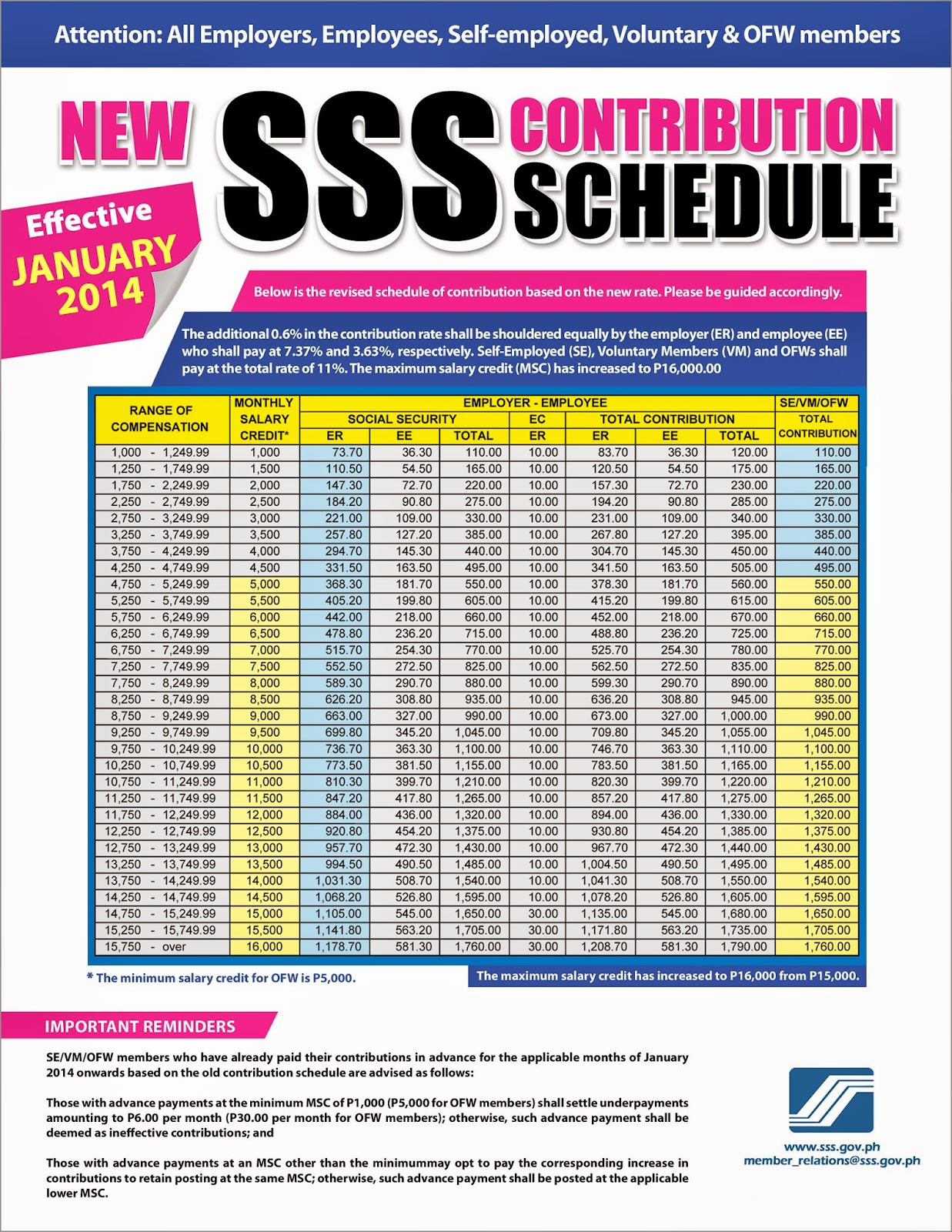

Who Can Pay SSS Contribution? Why Pay Your Contribution Regularly? How To Compute Your Monthly SSS Contribution: The Basics The New SSS Contribution Schedule The 2023 SSS Contribution Table 1. Employed Members 2. Self-employed Members 3. Voluntary and Non-Working Spouse Members 4. OFW Members 5. Household Employers and Kasambahay Tips and Warnings

BIR Tax Information, Business Solutions and Professional System SSS

New SSS Contribution Table for 2023 2023 Update: Based on SSS Circulars No. 2022-033, 034, 035, 036, and 037 signed by SSS President and CEO Michael G. Regino, the contribution rate for 2023 is 14%, which is one percent higher than for the previous year.

How to Compute for SSS Contribution « EPINOYGUIDE

SSS Contribution Table for 2024. December 18, 2023. As the year draws to a close, it's time to gear up for potential updates in various government agencies' rates and fees, including the Social Security System (SSS). Every new year may usher in changes, and it's important to be informed about these adjustments.

SSS Online Registration and Steps to Check SSS Your Contribution Online

COVERAGE & COLLECTION PARTNER / CONTRIBUTION SUBSIDY PROVIDER SMALL BUSINESS WAGE SUBSIDY PROGRAM Member Login Register. Employer Login. SSS Building East Avenue, Diliman Quezon City, Philippines. For comments, concerns and inquiries contact: SSS Hotline: 1455.