Mastering the Hammer Candlestick Pattern A StepbyStep Guide to Effective Trading Forex Bloging

Unlike the previous two patterns, the bullish engulfing is made up of two candlesticks. The first candle should be a short red body, engulfed by a green candle, which has a larger body. While the second candle opens lower than the previous red one, the buying pressure increases, leading to a reversal of the downtrend. 4.

Bullish Hammer Candlestick Pattern A Trend Trader's Guide ForexBee

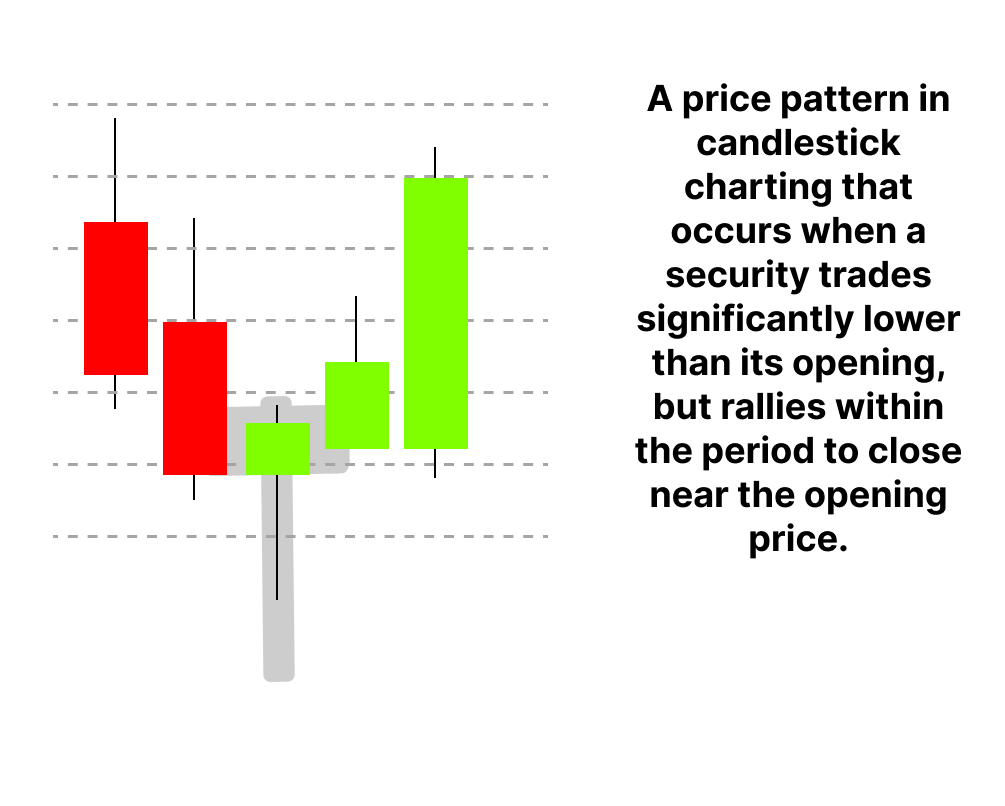

The hammer puts in its appearance after prolonged downtrend. On the day of the hammer candle, there is strong selling, often beginning at the opening bell. As the day goes on, however, the market recovers and closes near the unchanged mark, or in some cased even higher. In these cases the market potentially is "hammering" out a bottom.

Candlestick Patterns The Definitive Guide [UPDATED 2022]

A hammer is a price pattern in candlestick charting that occurs when a security trades significantly lower than its opening, but rallies within the period to close near the opening price..

What is a Hammer Candlestick Chart Pattern? NinjaTrader Blog in 2021 Candlestick chart

Bullish Candlestick Patterns Hammer. A hammer is a candlestick with a long lower wick at the bottom of a downtrend, where the lower wick is at least twice the size of the body. A hammer shows that despite high selling pressure, bulls pushed the price back up near the open. A hammer can either be red or green, but green hammers may indicate a.

What is and How to Trade on a Hammer Candlestick? Phemex Academy

Inverted Hammer (bullish) & Shooting Star (bearish) This candlestick is, as you would expect - a hammer turned on its head. It is a candle with a small body and long upward wick, signally a possible reversal. Where it appears in a chart affects whether it's an inverted hammer or a shooting star. An inverted hammer forms after a downtrend or

Inverted Hammer Candlestick Pattern PDF Guide Trading PDF

Hanging Man Bearish single candle reversal pattern that forms in an up trend. Shooting Star Bearish single candle reversal pattern that forms in an up trend. BEARISH Bearish Engulfing Bearish two candle reversal pattern that forms in an up trend. Bearish Harami Bearish two candle reversal pattern that forms in an up trend. Dark Cloud Cover

Hammer Candlestick Pattern The Complete Guide 2023

2.Hammer Candlestick Pattern (pdf) The Hammer is a singular candlestick pattern that typically forms after a downtrend. Visually, it resembles a hammer, featuring a small real body near the top of the candle and a long lower shadow. The crucial elements that define a Hammer include a small or nonexistent upper shadow, a long lower shadow, and a.

How To Trade Blog What Is Hammer Candlestick? 2 Ways To Trade Effectively With This Candlestick

The Hammer and Hanging man are simple reversal signal of single Japanese candlesticks chart. Exhibition 1 shows how it looks like. See Full PDF Download PDF Related Papers JAPANESE CANDLESTICK CHARTING TECHNIQUES A Contemporary Guide to the Ancient Investment Techniques of the Far East James Krobot Download Free PDF View PDF

Ossidare Sei uomo daffari inverted hammer candlestick pattern fischio sufficiente saccheggio

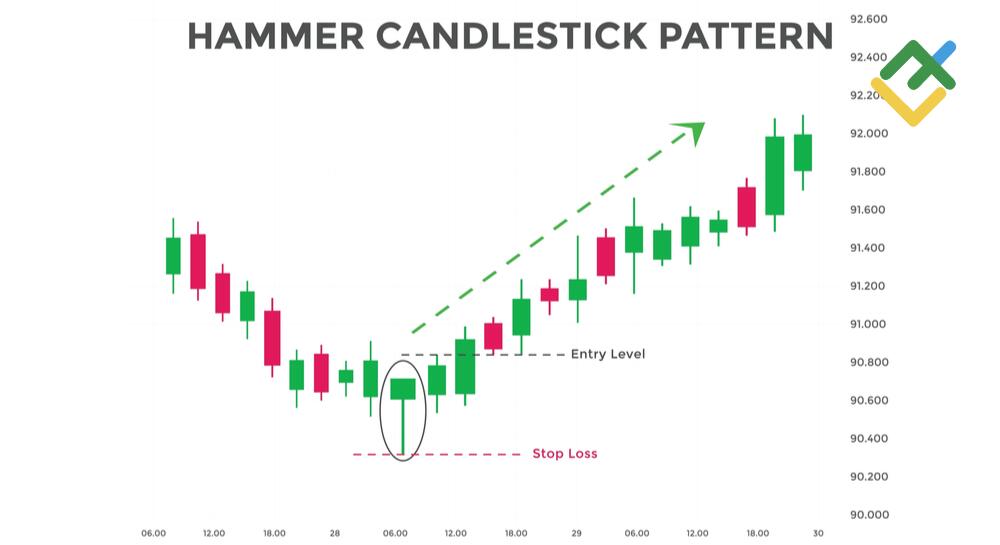

Conclusion. So in this hammer trading strategy guide, you've learned: A Hammer is a (1- candle) bullish reversal pattern that forms after a decline in price. 3 things you must know about Hammer: 1) it's usually a retracement against the trend 2. It doesn't tell you the direction of the trend 3.

35 Highly effective Candlestick Chart Patterns Each Dealer Ought to Know

Hammer: The hammer candle is a single candlestick pattern. The hammer has a small body, and the lower wick size is at least twice the size of the body. This candlestick has no upper wick, or sometimes it has a tiny upper wick, which is okay. Inverted Hammer: The inverted hammer is a single candlestick.

Hammer Candlestick Pattern Meaning, Examples & Limitations Finschool By 5paisa

The bullish hammer is a significant candlestick pattern that occurs at the bottom of the trend. A hammer consists of a small real body at the upper end of the trading range with a long lower shadow. The longer, the lower shadow, the more bullish the pattern. The chart below shows the presence of two hammers formed at the bottom of a downtrend.

Hammer Candlestick Pattern with FREE PDF Download Trading PDF

1. Hammer 2. Bullish Engulfing Bar 3. Piercing Pattern 5. Three White Soldiers 6. Three Inside Up 7. White Marubozu 8. Bullish Harami 9. Inverted Hammer 10. Tweezer Bottom 11. Three Outside Up 12. Bullish Counterattack 13. On-Neck Pattern 14. Dark Cloud Cover 15. Hanging Man

Bullish Hammer Candlestick Pattern A Trend Trader's Guide ForexBee

The hammer candlestick appears at the bottom of a down trend and signals a bullish reversal. The hammer candle has a small body, little to no upper wick, and a long lower wick - resembling a.

Bearish Candlestick Patterns Riset

58 Candlestick Patterns PDF Manual: FREE Download December 9, 2023by AliFx Download FREE PDF 📄 Candlestick patterns are a key part of trading. They are like a special code on a chart that shows how prices are moving. Imagine each pattern as a hint about what might happen next in the stock market. History of Candlestick Charting

Forex Candlestick Patterns Fast Scalping Forex Hedge Fund

dragonfly dojis are similar to hammer and hanging man patterns, which are discussed later in this guide. Hammer A "hammer" is a candlestick with a small body (a small range from open to close), a long wick protruding below the body, and little to no wick above. In this respect it is very similar to a dragonfly doji; the primary difference

What is a Hammer Candlestick Chart Pattern? LiteFinance

A hammer candlestick is formed when a candle shows a small body along with a long lower wick. The wick (or shadow) should have at least twice the size of the candle body. The long lower shadow indicates that sellers pushed the price down before buyers pushed it back up above the open price. Below you can see the opening price (1), the closing.