/https:%2F%2Fblogs-images.forbes.com%2Flearnvest%2Ffiles%2F2016%2F09%2Fstack-of-credit-cards-1200x890.jpg)

How Many Credit Cards Should You Really Have?

How many credit cards you should have is totally up to you. For some people, "too many" could be a single credit card. For others, it could be five or more. And in some cases, it's relatively easy for someone to juggle more than 20 cards without overspending or missing payment due dates.

How many credit cards does an average person has? Leia aqui Is 10

Dear JDL, As with almost every question about credit reports and credit scores, the answer depends on your unique credit history and the scoring system your lender is using. "Too many" credit cards for someone else might not be too many for you. There is no specific number of credit cards considered right for all consumers.

Does having multiple credit cards hurt your credit? Leia aqui Is 3

The average American now holds 3.84 credit cards. That figure is down 4% from 2019, and it follows a pattern of U.S. consumers shedding credit card debt as the coronavirus pandemic spread.

Is 3 credit cards too many? How many should I have Bright

Here's how I assess how many is too many. See related: Best credit cards of 2021. You may have too many credit cards if. You can't keep track of your accounts. If you can't keep track of your due dates, balances and other account information, then you have too many cards. This isn't an issue for me, thankfully.

Can You Have Too Many Credit Cards?

The ideal number of credit cards. There is no "perfect" number of credit cards a person should have. What's manageable for one consumer may be overwhelming to another. For example, if you're starting out or recovering from bad credit (or bankruptcy), having one credit card may be sufficient. It shows lenders that you're establishing a record.

How Many Credit Cards Are Too Many? The Frugal Creditnista

To answer how many credit cards is too many, you're going to be the best judge because one number does not fit everyone. However, we're here to help you decide. For some people, having several credit card accounts makes sense. For others, meeting all your needs with a single credit card might be the best option. In this article, we'll review:

Can You Have Too Many Credit Cards? How Many Should You Have?

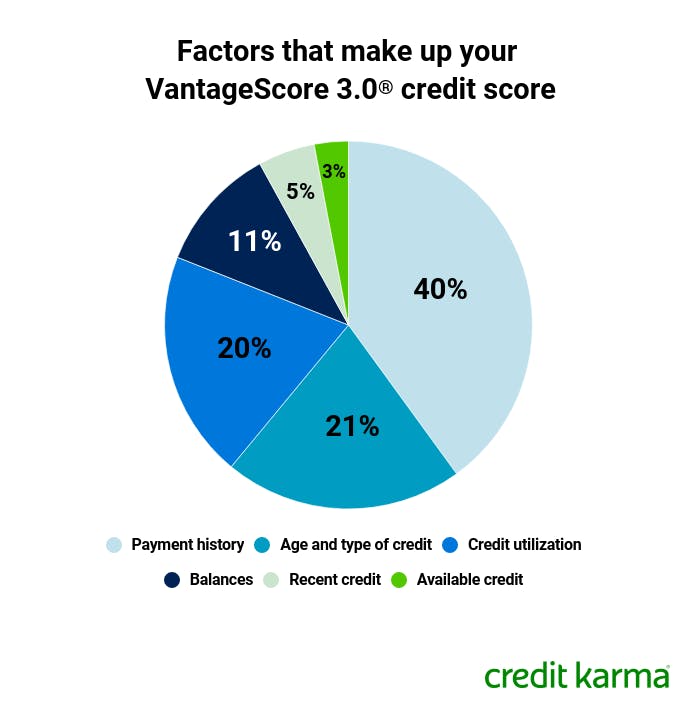

For example, if you have two credit cards each with a $1,000 credit limit, and most months you charge $800 on both cards, your credit utilization rate is 80%. That's too high! (The ideal credit utilization ratio is below 30%.) Even if you pay off your cards on time and in full month after month, you'll still be penalized on your credit report .

How Many Credit Cards Is Too Many? YouTube

The Bottom Line. Having a lot of credit cards can hurt your credit score under any of the following conditions: You are unable to keep up with your current debt. Your outstanding debt is more than.

Does Closing or Cancelling Credit Cards Help Your Credit Score or Hurt

Explore the question "Is 3 credit cards too many?" as we delve into the pros, cons, and expert advice on juggling multiple credit cards responsibly. Introduction.

How Many Credit Cards Is Too Many

Watch for these key signs that you have too many cards in your wallet, so you can take action. 1. You can't keep up with payments. Not being able to keep up with payments is an immediate red flag.

How Many Credit Cards Is Too Many? Bad Credit Mentor

In the U.S. alone, the value of revolving credit outstanding in 2022 amounted to approximately $1.12 trillion. Additionally, Forbes reported that the average credit card debt per borrower was $5,474 in the third quarter of 2022—meaning that credit card debt can quickly stack up and overwhelm borrowers.

How Many Credit Cards Is Too Many? Nationwide Credit Clearing

Most lenders require at least three open credit accounts if you want a conventional mortgage. You can improve your credit score. The new card will increase your overall credit limit, and if your.

Does having too many credit cards affect your credit score? Leia aqui

Add in the $95 annual fee for the Alaska Airlines Visa® credit card and cardholders are basically getting an airline ticket of any value for a companion for a little over $200, assuming the card.

Is it OK to have 7 credit cards? Leia aqui Is it too much to have 7

Now, say you apply for an additional credit card with a credit limit of $10,000. If approved, your total available credit jumps from $15,000 to $25,000. And as long as you don't charge anything to.

Credit cards How to know if you have too many

Is 3 Credit Cards Too Many? While owning 3 credit cards isn't the worst thing in the world, it is certainly leading you towards a slippery slope. Truth be told, there isn't much need to hold more than three different credit cards. The more you spend across these cards, the more difficult it will be to pay off your debt.

How many credit card should you have? Leia aqui How many credit cards

Too many credit cards might for most people could be six or more, given that the average American has a total of five credit cards. Everyone should have at least one credit card for credit-building purposes, even if they don't use it to make purchases, but the exact number of cards you should have differs by person.